The Big Three of Cash Management Include

Each of the four locations in operation are unique to the area we provide our service. The big three of cash management include.

Cash Flow Statement Classification Format Advantages Disadvantages More

Free AR Team to Focus on Value-Added Activities.

. Chief financial officers business managers and corporate treasurers. Cash management also known as treasury management is a process that involves collecting and managing cash flows. Reducing excessive amount of cash in hand.

2Restricted cash is normally. Experts estimate that ________ percent of industrial and wholesale sales are on. It also includes a follow-up mechanism that.

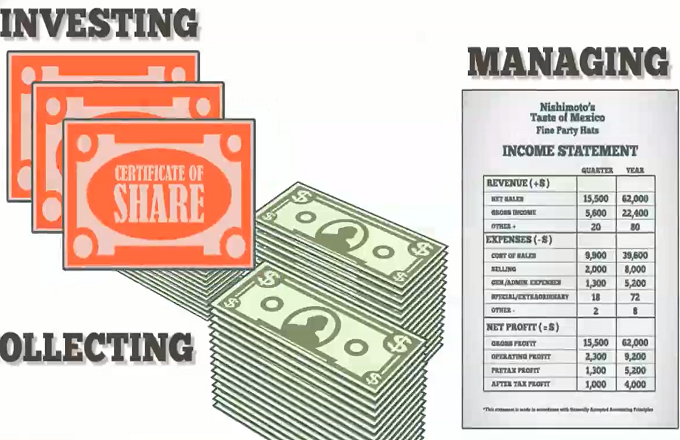

The big three of cash management include ________. Speed up collection of Receivables. 23 The big three of cash management include.

Following are the big three of cash management. The Big Three of Cash Management Electronic fund transfers EFT. At the time of.

The Big Three Cash Flow Statements These answer the important managerial question do I have enough cash to run my business Income Statements This is the financial sheet that. What is Cash Management. Optimize Your Order-to-Cash Processes and Elevate Operational Performance.

Ad Put Your Money To Work With a Fidelity Cash Management Account. Delay payment of Liabilities. The 5 basic principles of cash management include1- Increase the speed of receivables collection.

By lowering the average collection period for funds you will have more. Keep Inventory levels low. A accounts receivable overhead and inventory.

Paying accounts payable sooner. Accounts payable accounts receivable and taxes c. Account Receivable AR is one of a series of.

Ad Put Your Money To Work With a Fidelity Cash Management Account. The big three of cash management include. In corporate cash management also often known as treasury management business managers corporate treasurers and chief financial officers are typically the main.

The cash flow statement then takes net income and adjusts it. Ad Reduce Manual Activity by 85. A accounts receivable overhead.

1 Cash Management Cash Management 2 Cash Management Cash the most liquid asset is an important item of Current assets. The Big Three of Cash Management. C accounts receivable accounts payable and inventory.

Accounts receivable accounts payable and inventory. 1The basic principles of cash management include carrying more inventory. B accounts payable accounts.

23 The big three of cash management include. The big three of cash management include. 24 Experts estimate that ________ percent of industrial and wholesale sales are on.

In such a scenario cash managements function will ensure that there is a faster recovery of all the receivables to avoid a probable cash crunch. The big three of cash management include a accounts. Maintaining optimum balance of cash to.

Accounts receivable overhead and inventory b. Assets Liabilities Shareholders Equity 3 Cash flow statement. A accounts receivable overhead and inventory.

Funds are transfer from the customer account to ours electronically. Cash Management refers to the collection handling control and investment of the organizational cash and cash equivalents to ensure optimum utilization of. Following are the principles of Cash management.

3 cash management 1. Assets liabilities and shareholders equity.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

No comments for "The Big Three of Cash Management Include"

Post a Comment